N.I. 230.20 Brexit. Fin periodo transitorio

Share on Social Networks

Compartir enlace

Usar vinculo permanente para compartir en redes socialesShare with a friend

Por favor iniciar sesión para enviar esto document por correo!

Incrustar en tu sitio web

37. GVMS - Imports overview from 1 July 2021

38. GVMS - Exports overview from 1 July 2021

81. Case studies

11. Border formalities between GB and the EU at the end of the Transition Period Industry Day - Spain 10 December 2020

12. Hugh Elliott British Ambassador to Spain

13. Pilar Jurado Director Aduanas e Impuestos Especiales

14. Hilario Albarracín President KPMG España

15. Stella Jarvis Director Planning and Assurance Border and Protocol Delivery Group (BPDG)

19. Margaret Whitby EU Member States Engagement Border and Protocol Delivery Group (BPDG)

29. Customs, Transit and Excise update Flavia Munteanu, Barry Jordan and Mojgan Ahmad HMRC

35. Common transit convention (CTC) ● The CTC allows movement of goods under Duty suspense between EU member states and a number of neighbouring countries.These countries include Iceland, Norway, Switzerland, Lichtenstein, FYR Macedonia, Turkey, and Serbia. ● The UK will accede in its own right at the end of the transition period on 01//01/21. ● CTC allows the suspension of customs checks and payments of duties until the goods reach their destination. ● In order to move goods under CTC there are 3 distinct customs functions ○ Office of Departure ○ Office of Transit ○ Office of Destination ● The Office of Departure and Destination functions can be completed at a customs office or an approv ed location ( known as authorised Consignor/Consignee). ● The Office of Transit functions are a requirement placed on CTC members that ○ must be performed when goods arrive in a new customs territory and ○ must be completed at a customs office upon entry, could be at or near the Border.

44. VAT: Goods in consignments up to £135 in value ● For business to consumer (B2C) supplies of overseas goods into the UK in consignments that up to a value of £135, the seller, or the online marketplace where it facilitates the supply, will be liable to register and account for UK VAT on their VAT return. ● For business to business (B2B) supplies where a VAT registered business customer provides its VAT registration number to the seller or online marketplace, the customer will account for the VAT on their VAT return by a reverse charge. ● These rules do not apply to consignments containing excise goods, or to non-commercial transactions between private individuals. Such goods will be subject to the rules for consignments of goods more than a value of £135

45. VAT: Goods in consignments more than £135 in value ● Overseas consignments of goods of more than £135 in value imported into the UK will be subject to import VAT at the point of importation. ● Where the importer is not VAT registered in the UK, Import VAT will be payable at the border. ● However, the introduction of postponed VAT accounting (PVA) on 1 January 2021 will allow businesses registered for VAT in the UK to declare and recover import VAT on the same VAT return, rather than having to pay at the border and recover it later . ● They will be able to use PVA to account for import VAT on their VAT return for goods imported into: ○ Great Britain from anywhere outside the UK ○ Northern Ireland from outside the UK and EU

49. SPS and controlled goods update Duncan Lawson Department for Environment Food and Rural Affairs

71. High-risk food and feed not of animal origin (HRFNAO) David Bunn Food Standards Agency

47. Juan José Blanco Customs and Indirect Tax Partner KPMG España

48. Q&A Facilitated by BPDG

75. Alicia Sánchez Deputy Director General of Inspection, Certification and Technical Assistance in Trade Ministry of Industry, Tourism and Trade

76. Alejandro Lorca Area Coordinator General Subdirectorate of Sanitary Agreements and Border Control Ministry of Agriculture

77. Borja Iglesias Senior Technician, International Merchandise Control Area Ministry of Health

78. Carmen Mulet Regulatory, Administrative and Competition Law Department Director KPMG España

79. Q&A Facilitated by BPDG

85. Keep business moving Plenary session Border and Protocol Delivery Group

27. No documents no transport! For goods to leave GB or to arrive in the EU Prepare, prepare, prepare

43. V AT: Goods in consignments up to £135 in value ● For imports of goods from outside the UK in consignments that are up to £135 in value we will be moving the point at which VAT is collected from the point of importation to the point of sale. This will mean that UK supply VAT, rather than import VAT, will be due on these consignments. ● Low Value Consignment Relief, which relieves import VAT on consignments of goods valued at £15 or less will be abolished. ● Online marketplaces (OMPs), where they are involved in facilitating the sale, will be responsible for collecting and accounting for the VAT. ● For goods sent from overseas and sold directly to UK consumers without OMP involvement, the overseas seller will be required to register and account for the VAT to HMRC.

50. Agenda 3. Food Labelling 4. Geographical Indications 5. Wood Packaging Materials 1. The new SPS regime EU to GB • Plants and plant products • Live animals and products of animal origin • IPAFFS 2. The new SPS regime GB to EU • Live animals and products of animal origin • Plants and plant products • Certification

59. Import of Products Animals Food and Feed System (IPAFFS) - SPS EU to GB New sanitary and phytosanitary (SPS) controls will apply to goods exported to GB from the EU from 1 January 2021 • IPAFFS will be used by GB importers to pre-notify some SPS imports • The system is already live and currently being used for the notification of live animals, germinal products and animal by-products (ABP) travelling on Intra Trade Animal Health Certificates (ITAHCs) and commercial documents (DOCOMs) alongside TRACES & TRACES NT • From 2021, IPAFFS will be used to pre-notify GB officials before goods subject to SPS controls enter the country from the EU in a phased approach starting with live animals, germinal products and ABP

63. Food Labelling Food business operator (FBO) addresses for goods marketed in the UK: Until 30 September 2022, you can continue to use an EU, GB or NI address for the FBO on pre-packaged food or caseins sold in GB. From 1 October 2022, pre-packaged food or caseins sold in GB must include a UK address for the FBO. If the FBO is not in the UK, include the address of your importer, based in the UK. From 1 January 2021, pre-packaged food or caseins sold in NI must include a NI or EU FBO address. If the FBO is not in NI or EU, include the address of your importer, based in NI or the EU.

73. Import requirements for High-risk food and feed not of animal origin (HRFNAO) April 2021 • All HRFNAO on EU market exported to GB to be pre-notified on IPAFFS • HRFNAO from EU continues to enter GB via any entry point • HRFNAO from EU not subject to any import checks

25. Keep business moving At this point it is still uncertain what exactly the trade relationship will be with the United Kingdom after end of the Transition Period. We do know that customs procedures will apply to the trade between the UK and the EU. Today the paperwork needed to transport goods between the EU and the UK consists of a couple of documents: an invoice and contract of carriage. From 1.1.21 at least 9 additional procedures are added, e.g the certification of the goods, export declaration, the exit of the goods and the requirements needed to then enter the EU, and of course requirements to import goods into GB. How much time companies will have to spend on customs formalities depends on the individual situation. BUT.....it all starts with an export declaration

68. • The UK Government will establish new UK GI schemes on 1 January 2021. • All existing UK products registered under the EU's GI schemes by the end of the transition period w ill remain protected under the UK GI schemes. • The new UK GI logos are available to download on GOV.UK and can be used from 1 January 2021. • Producers of GIs registered before the end of the transition period, that are required to use the U K GI logos, will have until 1 January 2024 to adopt the logos. The logos will remain optional for produce rs outside of GB. • All UK GIs registered under the EU GI schemes at the end of the transition period to continue to receive protection in the EU. Geographical Indications (GIs)

72. Import requirements for High-risk food and feed not of animal origin (HRFNAO) There will be a phased introduction of import controls for EU high-risk food from the EU post the Tr ansition Period. January 2021 • No new import requirements on RoW HRFNAO imported into the EU and then exported into GB • RoW HRFNAO transiting through EU to GB must be pre-notified on IPAFFS, enter GB via BCP and be subject to import checks • RoW HRFNAO direct imports into GB only change is pre-notification via IPAFFS

86. Poll 3 Following the webinar, I have a better understanding of UK border procedures and the action that needs to be taken by the end of the transition period and I will share this detail with my customers or members of my business organisation. ● Yes ● No #BPDG

87. Keep business moving 6 immediate actions to prepare for goods exiting GB and entering the EU at the end of the transition period: • Register for an EORI number with the UK • Pre-apply EU EORI number if you need one • If exporting, the export declaration and S&S declaration is merged • If using transit, make sure the TAD is activated before your goods get to the GB exit point and tha t transporter is given the paper TAD to present at the border. • Import / S&S data entry into the EU – if you are not using transit, your haulier will also be requi red to present the MRN of a EU Member States importation & separate Safety & Security • Agree responsibilities with your customs agent and/or logistics provider

53. 1 January 2021: • Pre-notification and phytosanitary certificates will be required for ‘high-priority’ plants/product s • Documentary checks will be carried out remotely • Physical checks will be carried out on ‘high-priority’ will take place at destination or other auth orised premises • EU Exporters must apply for a phytosanitary certificate from the relevant competent authority of th e EU country of origin • GB Importers must submit import notifications prior to arrival, along with the phytosanitary certif icate • Checks will be carried out by Plant Health and Seed Inspectors (PHSI) from the Animal and Plant Health Agency (APHA) and the Forestry Commission (FC) in England and Wales, and the Scottish Government in Scotland Imports - Plants and Plant Products (SPS)

24. Poll 2 Which of the following statements best applies to you/your business? a. I do not understand what actions I need to take for the end of the transition period. b. I know what actions I need to take; but I have not yet taken any actions. c. I have started to take actions; or plan what I need to do. d. I have taken the actions I need to be ready. #BPDG www.sli.do

39. Excise • From the 1 January 2021, the Rest of World rules will apply to imports and exports of excise goods moving between GB and the EU. Businesses will need to complete customs import and export declarations using the relevant codes for duty paid or suspended goods • If businesses move duty suspended excise goods to and from a tax warehouse to the place they enter and exit GB they must use the UK version of Excise Movement and Control System (UK EMCS). UK EMCS must also be used to move duty suspended excise goods from UK warehouse to UK warehouse

46. María González Pérez Subdirección General de Gestión Aduanera Aduanas e Impuestos Especiales

54. Imports - Plants and Plant Products (SPS) 1 April 2021: • All regulated plants and plant products will be required to be accompanied by a phytosanitary certificate (i.e. not only those categorised as ‘high-priority’) 1 July 2021: • Physical checks for plants/products increase • Commodities subject to sanitary and phytosanitary (SPS) controls will need to enter via a Point of Entry with an appropriate Border Control Post (BCP) • All ID and physical checks for plants and their products will move to Border Control Posts, either at existing points of entry or at new inland sites

80. Break - see you in 10 minutes! Which of the following statements best applies to you/your business? a. I do not understand what actions I need to take for the end of the transition period. b. I know what actions I need to take; but I have not yet taken any actions. c. I have started to take actions; or plan what I need to do. d. I have taken the actions I need to be ready. #BPDG www.sli.do

1. Nº 2 30 . 20 Madrid, 31 de diciembre de 20 20 BREXIT. FIN PERIODO TRANSITORIO

20. Readiness polls are running Please answer our short questions Go to sli.do on your browser or phone Use the code #BPDG #BPDG www.sli.do

21. Poll 1 Are you/is your business aware that the end of the transition period will have an impact on the way you trade with the UK? a. Yes b. No #BPDG www.sli.do

23. Trader readiness among EU businesses Spain Netherlands Nordic / Baltic Poland Ireland

17. UK Border Infrastructure • Additional infrastructure is needed to handle transit (CTC) movements from 1 January 2021. Additionally, Border Control Posts will be required in Great Britain for handling SPS checks on goods from the EU from 1 July 2021. • Where GB ports have the capacity to build on site, they were able to apply for financial support to a Port Infrastructure Fund. Where ports do not have the space, HMG are building inland sites. • Some inland sites are already completed and others are under construction. The final list will be published shortly.

33. Full customs controls from 1 July 2021 • Traders will have to make full customs declarations... • ...Or use simplified procedures if they are authorised to do so At the point of importation on all goods and pay relevant tariffs • Safety and Security declarations will be required

67. Chemicals Option 2: The EEA exporter can register the substance under UK REACH using a UK-based entity. Either a GB based Only Representative or an affiliate GB importer Option 1: Your GB customer will register the substance under UK REACH. A ‘notification’ provision is available for your GB downstream users to ensure continuity of supply at the end of the Transition Period Actions for EU businesses - access to the GB market:

18. UK Border Infrastructure From January 2021, infrastructure will be available to handle: • Transit / CTC processing – Offices of Departure and Destination to start and end transit / CTC movements, including the issue of Transit Accompanying Documents (TADs), and facilities for Office of Transit compliance checks. • ATA Carnet processing – offices to wet stamp ATA Carnets for temporary imports and exports. • CITES processing – to wet stamp CITES permits accompanying relevant goods.

56. Live Animals and Animal Products - EU to GB 1 April 2021: • All products of animal origin (POAO) – for example meat and fish, honey, milk or egg products – will now require the relevant Export Health Certificates (EHCs) and pre-notification by the GB importer using Import of Products Animals Food and Feed System (IPAFFS) • EU exporters will be required to obtain the relevant EHC and ensure that it travels with the consignment • GB Import requirements for live animals, high-risk animal by-products (ABPs) and POAO under safeguard measures introduced on 1 January 2021 will continue to apply • New import requirements for low-risk ABPs will not apply until 1 July 2021

16. Implications for businesses who trade with GB Significant challenges for all businesses which trade between EU and GB: • Particular challenge for SMEs, especially in light of dealing with the impact of COVID • All businesses who trade between the EU and GB need to prepare as soon as possible for the new processes and controls that regardless of the outcome of the negotiations will apply from 1 Jan 2021

64. Food Labelling Origin labelling in general for goods marketed in GB • You may label food from NI and sold in GB as ‘UK(NI)’, ‘United Kingdom (Northern Ireland)’ or ‘UK’. • Until 30 September 2022, food from and sold in GB can be labelled as ‘origin EU’. • From 1 October 2022, food from GB must not be labelled as ‘origin EU’. Origin labelling in general for goods marketed in NI • Where EU law does not require an EU member state to be indicated, food from and sold in NI can continue to use ‘origin EU’ or ‘origin UK’. • From 1 January 2021, you should label food from and sold in NI as ‘UK(NI)’ or ‘United Kingdom (Northern Ireland)’ where EU law requires member state. Origin labelling of specific foods Some foods will continue to require either the country or countries of origin or the origin to be de scribed using specific other terms, known as origin indicators. For details of origin labelling of these foods, see our guidance here .

69. Q: Will EU products be protected in the UK? A: We of course intend to honour our legal obligations under the Withdrawal Agreement. Q: Can I use both the UK and the EU logo on my product? A: GI products that are protected under both the UK and EU schemes will be able to use both the UK a nd EU logos when the product is on sale in the UK. They will also be able to use both logos when the pr oduct is on sale in the EU, provided that this is not prohibited by EU regulations. Why is there a 3-year adoption period for the logos? A: This is based on research that a three year period reasonably allows businesses to incorporate labelling changes within their normal labelling cycles, to the point that the cost burden reduces by around 95% (compared with an immediate change requirement). As such a three year adoption period is assessed to have a negligible net business impact. This proposition was supported by the majority of GI stakeholders in our autumn 2018 public consultation. Geographical Indications (GIs) – Q&A

4. Al final del año, a los transportistas del Reino Unido y la UE también se les permitirá realizar algunos movimientos adicionales dentro del territorio del otro para hacer las operaciones internacionales más eficientes, ayudando al medio ambiente y brindando beneficios a los operadores de transporte y sus clientes. En general, se estima que más del 95% de los viajes de transporte del Reino Unido hacia y desde la UE seguirán funcionando exactamente como lo hacen ahora. El Acuerdo también establece disposiciones específicas para el transporte por carretera en la isla de Irlanda. Los transportistas de Irlanda del Norte podrán hacer negocios adicionales dentro de la República de Irlanda y existe flexibilidad para permitir que los servicios de autobuses y autocares transfronterizos continúen funcionando como lo hacen ahora. Por otra parte, para conocer los requisitos que Reino Unido ha establecido para el acceso a su mercado, puede consultar las Guías de acceso al mercado del Reino Unido a partir del 1 enero 2021 elaboradas por la Oficina Económica y Comercial de España en Londres. En estos documentos se explican los procedimientos aduaneros de importación en el Reino Unido, así como la introducción de controles fronterizos para los bienes controlados en tres etapas hasta el 1 de julio de 2021, y los modelos de despacho previo y almacenamiento provisional que se implantarán para las importaciones a partir del mes de julio de 2021. Además, se adjuntan notas informativas sobre temas horizontales, como la adaptación del marcado CE, los criterios sobre las reglas de origen, los cambios en el portal de licitaciones públicas o las implicaciones del IVA en el comercio electrónico para ventas B2C. Esta serie de documentos se completa con unos manuales específicos de productos sometidos a controles por etapas. Cada manual explica cuáles son las autoridades competentes en el Reino Unido para realizar los controles. En cada fase (enero, abril o julio de 2021) se describen los productos afectados por estos controles, los procedimientos telemáticos que aplican en la importación, dónde se localizan los

66. Chemicals • GB will replace EU regulations with an independent regulatory framework, UK REACH which will come into force on 1 January 2021 • Both GB and the EU will operate REACH frameworks, but the two systems will not be linked in any way . As such, businesses will need to take steps to ensure regulatory requirements are fulfilled on both sides of the channel in order to maintain continuity of supply chains • For Exports to GB : For many chemical shipments, there will be minimal impact at points of entry because regulatory control takes place away from the border • For Imports to the EU : There are additional requirements for exporters, namely appointing an EU-based Only Representative to maintain access to the EU market, but these do not take place at the border •Under the Northern Ireland Protocol, the existing EU chemicals regime EU REACH will continue to app ly in Northern Ireland. This will mean that there will be no change for NI-based businesses and they can continue trading with the EU/EEA as they already do.

74. Import requirements for High-risk food and feed not of animal origin (HRFNAO) July 2021 • All HRFNAO from the EU must enter GB via BCP with relevant approval having first been pre-notified to that BCP via IPAFFS • HRFNAO Consignments from the EU will be subject to import checks at the frequencies specified in legislation Details of all HRFNAO products can be found on the website of the UK’s Food Standards Agency - food.gov.uk/business-guidance/importing-products-of-non-animal-origin Details of UK BCPs and what they are approved for are available at gov.uk/government/publications/uk-border-control-posts-animal-and-animal-product-imports

22. Trader readiness among EU businesses This is a summary from recent EU engagement on border readiness events. Data sources (response rates, numbers and size of businesses and event) vary. Red : Unaware of actions required Orange : Aware but not started Green : Some action taken Blue : I am ready Nordic / Baltic

32. Export declarations from 1 January 2021 • Traders exporting goods from GB into the EU will need to submit export declarations for all goods • Traders will be required to submit Safety and Security information either via a combined export declaration, or a standalone Exit Summary Declaration • For excise goods or goods moving under duty suspense only , if moving the goods through a location that does not have systems to automatically communicate to HMRC that the goods have left the country, the trader must provide proof to HMRC after the goods have left that the goods have exited GB

58. POAO – Fishery Products – EU to GB Imports of most fishery products and live shellfish ready for human consumption will requ ire: From January 2021: • Catch certificates and other IUU documents will be required and subject to risk-based documentary checks. The GB importer will need to send these to the importing competent authority e.g Port Health Authorities prior to arrival. Exempt species are detailed in Annex I of the IUU Regulation From April 2021: As above, but • Goods to be accompanied by an Export Health Certificate (EHC), which will be subject to documentary checks • Import pre-notifications submitted by the GB importer in advance of arrival using IPAFFS. From July 2021: As above, but • Entry via an established point of entry with an appropriate border control post

61. • From 1 st January 2021 EU will require GB exporters to have export health certificates (EHCs) and phytosanitary certificates . • The Export Health Certificate Online (EHC Online) service will be used to control the safe export o f live animals and products of animal origin (POAO) and apply for EHCs. The system is already live • Applications for certificates for live aquatic animals are via the Centre for Environment Marine Aquaculture and Science and Marine Scotland. • An online service will be introduced for the application, processing and issuing of phytosanitary certificates for plants and plant products. The system to apply for export plant health phytosanitary certificates for exporting controlled plants and plant products from GB will move to EHC Online. • Exporters moving sanitary and phytosanitary goods from GB to the EU will need to work with their EU importers to pre-notify the EU authorities using the TRACES NT system. Export Certification Requirements – GB to EU

31. Import declarations - 1 January 2021 to 1 July 2021 Goods must be pre-lodged in advance of crossing if moving through a listed RoRo port or a location without existing systems or use transit CTC) • To facilitate readiness, traders moving non-controlled goods to GB will be allowed to declare their goods by making an entry into their own records. Information on what is required as part of that rec ord can be found in the Border Operating Model - 1.1.3 • Businesses will be required to keep records of their imports and submit this information, via a supplementary declaration within 6 months of import and pay the required duty via an approved duty deferment account • Traders moving controlled goods (e.g. excise goods) will need to make a frontier declaration. This declaration can be full, simplified, or a transit declaration depending on the trader's authorisation

36. Goods vehicle movement service (GVMS) Goods Vehicle Movement Service (GMVS) will, by July 2021: • Enable declaration references to be linked together so that the person moving the goods (e.g. a haul ier) only has to present one single reference (Goods Movement Reference or GMR) at the frontier to prove that their goods have pre-lodged all the necessary declarations • Allow the linking of the movement of the goods to declarations, enabling the automatic arrival in HM RC systems as soon as goods board so that declarations can be processed en route • Automate the Office of Transit function, marking the entry of goods into GB customs territory (this will be available for 1 Jan 2021 ) • Notification of the risking outcome of declarations (i.e. cleared or uncleared) in HMRC systems to b e sent to the person in control of the goods)

60. • The IPAFFS system will replace TRACES/TRACES NT (Trade and Control Expert System) in GB • To support trader readiness and adoption of IPAFFS ahead of the end of transition, a phased migration is planned. Import of Products Animals Food and Feed System (IPAFFS) - SPS EU to GB COMMODITY IPAFFS ‘Go Live’ EU / EEA countries Live Animals Already live Animal By Products Already live Germinal Products Already live Products of Animal Origin 1 st April 2021 High Risk Food / Feed not of Animal Origin 1 st April 2021 Plant / Plant Products From 1 st Feb 2021 (specific date tbc)

55. Live Animals and Animal Products - EU to GB (This includes live aquatic animals and fishery products) Health certificates • Requirements for export health certificates (EHCs) will be introduced in phases from January to Jul y 2021 • Health certificates will be substantially the same as existing EU certificates for imports from the rest of the world. You should use existing EU EHCs for guidance on what will be required 1 January 2021: • Pre-notification and health certificates will be required for live animals. Physical checks for live animals will continue to be carried out at destination • Products of Animal Origin (POAO) subject to safeguard measures will need pre-notification by the GB importer and the relevant EHC • GB Importer will supply a unique notification number (UNN) that must be added to the EHC • Animal by-products (ABPs) will continue with the current requirement to be accompanied by official commercial documentation. High-risk ABPs will require pre-authorisation, and high-risk ABP as well as Category 3 Processed Animal Protein will require pre-notification in advance

34. Temporary storage and pre-lodgement Border locations can either use the temporary storage model , or the newly developed pre-lodgement model (developed as an alternative for where border locations may not have the space and infrastructure to operate temporary storage regimes) • The temporary storage model allows goods to be stored for up to 90 days at an HMRC approved temporary storage facility, before a declaration is made and Government officials can carry out any checks before goods are released from the facility • The pre-lodgement model ensures that all declarations are pre-lodged before they board on the EU side - this will maintain flow, especially at high volume RoRo locations

70. Wood Packaging Material • From 1 January 2021 all wood packaging material moving between GB and the EU must meet ISPM15 international standards by undergoing heat treatment and marking • This includes pallets, crates, boxes, cable drums, spools and dunnage • Wood packaging material may be subject to official checks either upon or after entry to the EU • As there will be no immediate change to the biosecurity threat of wood packaging material originating from the EU at the end of the Transition Period, the UK will maintain its current risk-based checking regime for EU wood packaging material • More information can be found on the gov.uk website here

2. Nº 2 30 . 20 Madrid, 31 de diciembre de 20 20 BREXIT. FIN PERIODO TRANSITORIO Tras las comunicaciones que les hemos enviado acerca del borrador del acuerdo comercial entre Reino Unido y la Unión Europea, hemos recibido varias consultas sobre lo que pueda acontecer en relación con los trámites aduaneros que afectan al paso de mercancías entre ambas partes. Será necesario, sin duda, esperar a la experiencia real a partir del día uno de enero, ya que nada de lo acordado ni de los sistemas informáticos habilitados para agilizar la tramitación de declaración y despacho aduaneros han podido ser probados con suficiente profundidad ni por exportadores ni por autoridades aduaneras ni, por supuesto, por los transportistas. No obstante, de cara a clarificar lo más posible el nuevo escenario -en especial para los clientes de su empresa que envíen o reciban mercancías hacia o desde el Reino Unido- hemos querido comunicarle el siguiente resumen que viene a recordar algunas de las informaciones que les hemos ido haciendo llegar a lo largo de todo el proceso de materialización del Brexit y ahora con el borrador de acuerdo ya publicado (véase nuestra nota informativa 228.20 ): A partir del 1 de enero de 2021 (00.00 horas) los intercambios comerciales con Reino Unido (excepto Irlanda del Norte) se considerarán exportaciones e importaciones, lo cual tiene las siguientes implicaciones, con independencia de la conclusión del Acuerdo de Comercio y Cooperación entre la UE y Reino Unido: • Los envíos y recepciones de mercancías a y desde Reino Unido se deberán formalizar en declaraciones aduaneras . • Para la presentación de declaraciones es necesario disponer de un número EORI registrado en un Estado miembro de la UE. En el caso de España,

30. Customs • The UK will be introducing border controls at the end of transition period in stages - starting with some controls from 1 January 2021 and moving to full controls for all goods from 1 July 2021 • The requirement for Safety and Security declarations on import - Entry Summary Declarations (ENS) will be waived for 6 months • Traders importing controlled goods (such as excise goods) will be expected to follow full customs requirements from January 2021 • The UK will join the Common Transit Convention (CTC) in its own right from 1 January 2021 and will be subject to the requirements of the Convention. Moving to these requirements in stages will therefore not be applicable

5. controles, un diagrama de flujo del proceso, los pasos previos a la importación y, al llegar a frontera, con las responsabilidades del exportador e importador. C/ Príncipe de Vergara, 74, 3 planta - 28006 MADRID Tlf.: 91 451 48 01 / 07 – Fax: 91 395 28 23 E-mail: [email protected] Nota: Prohibida la edición, distribución y puesta en red, total o parcial, de esta información si n la autorización de A ST IC

57. Live Animals and Animal Products - EU to GB 1 July 2021: • All live animals and products of animal origin (POAO) will require pre-notification by the GB importer using IPAFFS and must be accompanied by an Export health certificate (EHC). They will need to enter via a Point o f Entry with an appropriate Border Control Post (BCP) with relevant checking facilities. • Animal by-products (ABP) must be accompanied by an EHC or other official documentation, depending on the ABP commodity being imported. Certain ABP will need to arrive at an established point of entry with an a ppropriate BCP. For certain ABP, pre-notification by the GB importer will be required • ID & physical checks for animal products will be introduced, which will be carried out at Border Control Posts, either at existing points of entry or at new inland sites • POAO, germinal products and ABP imported from the EU will be subject to a minimum level of 1% physical checks . High-risk live animals will continue to be checked at 100%. Some commodities, such as shellfish a nd certain ABPs, will be subject to higher minimum check levels. • During 2021, controls will be reviewed in light of existing and new trade agreements and any changes in risk status . Any changes following this review will be introduced after January 2022.

3. como se ha venido informando, se puede obtener a través de la sede electrónica de la Agencia Tributaria. • La presentación de declaraciones se puede efectuar por los propios operadores o utilizando un representante aduanero. • Algunos tipos de mercancías están sujetas a controles por parte de otros organismos diferentes de la aduana, por lo que resulta imprescindible informarse de la tramitación que es necesario realizar ante ellos antes de llevar a cabo la importación o exportación. Puede consultar la Carta al respecto emitida por la Agencia Tributaria. También puede consultar las medidas aplicables a cada mercancía en función de su clasificación arancelaria. Véase documentos adjuntos. • Irlanda del Norte, aunque forma parte del territorio aduanero de Reino Unido, continuará aplicando normativa de la UE en materia de aduanas, IVA e IIEE, entre otras. En el banner Brexit de la Secretaría de Estado de Comercio puede encontrar información adicional, así como los enlaces para realizar las diferentes tramitaciones y controles de mercancías correspondientes a esta Secretaría de Estado. A continuación, encontrará la declaración del Primer Ministro del Reino Unido y el documento explicativo: https://www.gov.uk/government/speeches/prime- ministers-statement- on - eu -negotiations- 24 -december- 2020 https://www.gov.uk/government/publications/agreem ents-reached-between-the-united-kingdom- of -great- britain-and-northern-ireland-and-the-european-union Como ya se ha comunicado, los operadores del Reino Unido y de la UE seguirán siendo capaces de proporcionar servicios hacia, desde y a través de sus territorios, sin restricciones y sin burocracia adicional, lo que brindará a los transportistas y operadores de autobuses y autocares del Reino Unido certeza y continuidad a medida que avanzamos hacia una nueva relación con la UE.

52. • Requirement for pre-notification and phytosanitary certificates for ‘high priority’ plants and plan t products from 1 January 2021 • Sanitary and phytosanitary (SPS) checks will take place away from the border at places of destinati on or other approved premises • An exhaustive list of ‘high priority’ plants and plant products is available here on GOV.UK . • The requirement for phytosanitary certificates is extended to all regulated plants and plant produc ts, from 1 April 2021 • For a list of plants and plant products that do not require SPS certificates, please refer to the G OV.UK website, available here • From 1 July 2021 , there will be an increased number of physical and identity checks • All checks will take place at Border Control Posts (BCPs) Imports - Plants and Plant Products (SPS)

65. Food Labelling • GB products of animal origin: exported to the EU27 must carry the ‘GB’ or full country name ‘United Kingdom’ on the health and identification marks. For guidance see the Food Standards Agency food.gov.uk • Food Business Operator addresses: pre-packaged food and caseins must have an EU or NI address, or an address of the EU or NI importer on the packaging or food label • Country of origin labelling: it will be inaccurate to label GB food as origin ‘EU’. Food from NI can continue to use 'origin EU'. Food from NI should be labelled 'UK(NI)' or 'United Kingdom (Northern Ireland)' where EU law requires member state. • The EU organic logo: belongs to the EU Commission and cannot be used from 1 January 2021 unless: your control body is authorised by the EU to certify UK goods for export to the EU, or the UK and the EU agree to recognise each other’s standards • The EU emblem: must not be placed on GB produced goods except where the ongoing use of the emblem after exit day has been authorised by the EU For UK food placed on the EU market, at the end of the Transition Period, the follow ing changes will take effect immediately:

88. Keep business moving Useful links: ● Gov.uk/transition landing page is a single location with a streamlined user journey where you can find guidance and the most up-to-date information to prepare for the end of the transition period. ● https://www.gov.uk/eubusiness ● https://www.gov.uk/government/publications/the-border-operating-model Guides to importing and exporting and for hauliers: ● https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/91 0155/How_to_import_goods_from_the_EU_into_GB_from_January_2021.pdf ● https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/91 0156/How_to_export_goods_from_GB_into_the_EU_from_January_2021.pdf ● https://www.gov.uk/guidance/transporting-goods-between-great-britain-and-the-eu-from-1-january-20 21-guidance-for-hauliers

28. EU to GB imports 1 July 2021 • Safety and security declarations • Full customs declarations, or use of simplified procedures if authorised to do so and the payment of relevant tariffs at import • Control of veterinary and sanitary and phytosanitary (SPS) goods at GB Border Control Posts (BCPs) 1 April 2021 • Pre-registration for all: • Products of animal origin (POAO) • High risk food not of animal origin • Regulated plants and plant products 1 January 2021 • Declaration and control for excise and controlled goods (full declaration or CFSP) • For standard goods, keeping records (EIDR or CFSP) - with a 6 month postponement on the full declaration, based on a self assessment • 6 month deferred payment • No safety and security declaration • Physical checks at destination for high risk veterinary and phytosanitary goods

51. • New sanitary and phytosanitary (SPS) controls will apply to goods imported to GB from the EU from 1 January 2021 • These controls will be introduced in stages up to 1 July 2021 , with different controls introduced at each stage for different commodities • Some processes and procedures will be introduced in stages up to 1 July 2021 for the import of live animals, animal products, fish and shellfish and their products, plants and plant products and high-risk food and fe ed not of animal origin Controls will be introduced in stages, and include the requirements for: • Import pre-notifications (GB importer action) • Health certification (such as an Export Health Certificate or Phytosanitary Certificate) • Documentary, identity and physical checks at the border or inland • Entry via a point of entry with an appropriate Border Control Post (BCP) with relevant checking facilities from 1 July 2021 Introduction to phased approach - EU to GB

62. Food Labelling Placing food on the GB and NI markets • Guidance on food and drink labelling changes from 1 January 2021 is available here. • You’ll need to make any required labelling changes for goods sold in GB by 30 September 2022 • Goods sold in NI will continue to follow EU rules for labelling, but you may need to make some labe lling changes However, the UK Government recognises that businesses will need time to adapt to these new labelling rules • Your label can contain other information if you need to comply with labelling requirements for anot her market Importing GB food to the EU Market • The European Commission issued advice in its notice to stakeholders, Withdrawal of the UK and EU food law , on the changes required to food labels for the EU market • Based on this notice, UK businesses will need to make the required changes to food labels in order to place food on the EU market as soon as the TP has ended • GB exporters are advised to seek advice from EU importing contacts For an overview of the actions food and drink businesses may need to take, visit here For food labelling specific guidance, visit here

26. Basics • The second iteration of the Border Operating Model was published on the 8th October. • There are also step by step import and export guides available on gov.uk • The haulier handbook is now available at Guidance for hauliers Checklist • Establish and agree Incoterms and conditions • GB Importers and exporters must have an EORI number issued by the UK • EU importers and exporters must have an EORI number issued by an EU Member State (EORI numbers issued by UK will not be valid in the EU following the end of the transition period) • GB haulier will also need an EU EORI if they are, for example, the responsible entity for entering E NS data into a MS Import Control System (ICS) for accompanied freight • Pre-applications can be done now and the numbers activated on 1 Jan or later

82. 1. Daniel has an EU EORI number - exporters will need to have an EU EORI number even if they use a forwarder or customs agent for export declarations. 4. Daniel submits the export declaration to Spanish customs systems. Includes s&s data 5. The Spanish customs system generates a Movement Reference Number (MRN) and produces an Export Accompanying Document (EAD) with a barcode and releases the merchandise automatically or after documentary or physical control. Case study 1 - exporting tomato seeds from ES to GB via Spanish Ports (from January 2021) non-transit Daniel - EU Exporter Claire - UK Importer Joe – Driver 7.Joe needs Claire’s (importer’s) EORI (to “evidence” that an entry has been made in Claire’s records) in case of a Border Force targeted / risk based intervention for their other reasons at Portsmouth. He also needs a copy of the PC. 12. The MRN (EAD) is scanned by Brittany Ferries and the driver must answer any questions from Spanish Customs officials. Only when the truck embarks on the ferry i.e the point of no return is the EAD discharged by Brittany Ferries IT communicating with Spanish systems to confirm that the ferry has departed Brittany Ferries (carrier) As Daniel has made a export declaration and has an EAD, he does not need to separately lodge an Exit Summary Declaration (EXS) into the Member State Export Control System (ECS) as the safety and security data is part of the EAD. 2. Daniel (the EU exporter) should agree terms and conditions with Claire (the UK importer) so that the responsibility for border formalities is clear. 9. Daniel provides Joe, the driver with the EAD / MRN and the PC 10. Claire has a GB EORI number and intends to use the deferred declaration procedure for her import to GB, so Joe carries a copy of her GB EORI number. 11. Joe’s firm completes a form for the carrier / Brittany Ferries to provide details of the goods including the first 4 digits of the Commodity / TARIC code and Joe transports the consignments to the spanish port. 13. Joe and the truck make the crossing from Spain to Portsmouth. 14. The consignment is now subject to APHA control, and the Plant Health and Seed Inspectorate (PHSI) decide if they wish to select the goods for a control. APHA decide not to check the goods and Joe dives to Claire’s warehouse. 16 Claire is VAT registered and so can use postponed VAT accounting to account for import VAT. This is paid quarterly and cannot be delayed six months. 15. Claire has checked the tariff rates, and once her goods arrive she updates the entry into her own records with detail from the import including the date and time of entry. 17 Within 6 months of 23 January, Claire will need to have applied and be authorised for simplified declarations (CFSP) for imports. She will need this to submit her supplementary declaration within 6 months of the date of import. 18. Claire submits the supplementary declaration before 23rd July 2021 (6 months after the import date). 19. Claire has registered for a duty deferment account, which is debited after she has submitted the supplementary declaration. No GB ENS data input is required by Joe, because the import is before 1 July 2021. 6. Claire has arranged collection of the goods with her haulage firm. ES administration HMG administration 3. Daniel has applied for and received a phyto-sanitary certificate (PC) from the relevant competent authority.. 3. 8. Claire has registered on the UK PEACH system, submitted the pre-notification of the import and arranged for a physical inspection at her registered warehouse (destination)

42. 32 E1 : Goods travel from the GB trader to the port of export. If duty paid, no control requirements. If duty suspended they travel on UK EMCS. E3: If goods entered to excise warehousing, goods declared on EU EMCS system. C2 : An import declaration is required when goods arrive in EU. C1 : An export declaration is required when goods leave GB. GB EU E4: EU EMCS movement ends when goods arrive at EU warehouse. GB-EU APPROACH: This is a movement of excise goods from GB to EU: The goods can be duty paid in the UK or duty suspended. If duty paid, drawback (reimbursement) is av ailable on exit from GB. If duty suspended, they will travel from the warehouse to the port of exit on UK EMCS. On entry into the EU the goods can be entered to free circulation, excise warehousing or customs special procedures. E2 : Excise movement on UK EMCS is closed on export from GB . UK excise duty can be reclaimed under drawback if duty paid Key Excise Control Excise DP Destination Customs Control Customs Ctl. No Dec Excise Duty Point Excise Drawback UK Duty Secured for NI DP Movement DS Movement Excise Interaction Customs Interaction C x : Ex :

10. 5 ECMT international road haulage permits - GOV.UK ● Goods moving over midnight; EUROPEAN COMMISSION Brussels, 14 July 2020 REV2 – replaces the notes “Guidance on customs” (REV1) dated 22 November 2019, see section 5.3 for EU position ● Data: Using personal data in your business or other organisation from 1 January 2021 Data protection at the end of the transition period ● Placing goods on the UK Market: Placing manufactured goods on the market in Great Britain from 1 January 2021 Category One Goods: List of Category One goods Haulier registration form for Government Secured Freight capacity Registering to make submissions to the MHRA from 1 January 2021 MHRA guidance - post transition period information Veterinary Medicines Directorate email address Regulating Medical Devices from 1 January 2021 Register medical devices to place on the market from 1 January 2021 End

41. 31 APPROACH: This is a movement of excise goods that are excise duty paid in the EU: The goods are exported from the EU excise duty paid. On entry into Great Britain, excise duty can be paid, or declared to excise duty suspension or customs special procedures. EU-GB: Duty Paid EU E1 : Duty paid goods moved to EU port of export on normal documentation. C1 : Export declaration made upon exit from EU . C2 : Under staged controls full import declaration made or if using CFSP, import declaration pre lodged before leaving the EU in GB. Goods declared to free circulation, excise warehousing or customs procedures. Goods arrived by end of next working day. GB E2 : Drawback (Reimbursement) can be used to claim back EU excise duty on export from EU MS . Key Excise Control Excise Destination Customs Control Customs Ctl. No Dec Excise Duty Point Excise Drawback UK Duty Secured for NI DP Movement DS Movement Excise Interaction Customs Interaction C x : Ex : E3 : If entered to excise warehousing, goods declared onto UK EMCS by the end of the next working day . E4 : If entered to free circulation no other formalities to complete at this stage. E5 : If entered to excise warehousing, UK EMCS is closed on receipt at GB warehouse . C3 : Under staged control, supplementary declaration submitted if CFSP used.

83. 1. Felix has an EU EORI number and has agreed incoterms and conditions for the sale to Emma) so that the responsibility for border formalities is clear. 2. Felix pre-lodges the export declaration in the Spanish customs system which produces an Export Accompanying Document (EAD) which is also a merged EXS safety and security declaration into the Export Control System (ECS) noting Coquelles/ France as the office of exit *if the movement starts in another Member State the EAD should be raised there, if not the EU exporter or their agent will need TVA registration in France or they will have to use a fiscal representative. 3. T he Spanish customs system generates a Movement Reference Number (MRN) and produces an Export Accompanying Document (EAD) with a barcode. Case study 2 - exporting auto-parts (standard goods) from the EU to GB via Eurotunnel / short straits (from January 2021) non-transit Felix - EU Exporter Emma - UK Importer Joe – Driver 8. Joe only needs importer’s EORI (to “evidence” that the pre-lodged import declaration has been done) if asked as part of a Border Force targeted / risk based intervention at Coquelles. 9. The MRN (EAD) is scanned at the Eurotunnel pitstop*. (Both Eurotunnel / ports will scan the MRN *Eurotunnel account holders can also use the new “Eurotunnel Border Pass” service to submit / pre-load their data in advance, reducing the questions at the pitstop Only when the truck gets on the shuttle (or ferry) i.e the point of no return is the EAD discharged by Eurotunnel’s IT communicating with SI Brexit to confirm that the shuttle has departed - this discharges the export for zero rating the supply. Eurotunnel (carrier) 5. Felix provides Joe with the EAD / MRN. * If Joe carries several consignments, Felix will combine them into a single MRN using the SI Brexit “logistics envelope” . 6. Emma has a GB EORI number and intends to use the deferred declaration procedure for her import to GB, so Joe carries a copy of her GB EORI number. 7. Joe transports the consignments to the Eurotunnel Coquelles terminal 11. Joe arrives at the Folkestone terminal, leaves the shuttle train and drives onto the M20 and on towards the delivery address.. 13. Emma is VAT registered and so can use postponed VAT accounting to account for import VAT. This is paid quarterly and cannot be delayed six months. 6a Emma has an EORI number and has already provided it to Joe 12. She has checked the tariff rates, and once her goods arrive she makes the entry into her own records (EIDR) with detail from the import including the date and time of entry of the goods. 14. Within 6 months of date of import, Emma needs to have applied for and be authorised to use Customs Freight Simplified Procedures (CFSP) to make her supplementary declaration 15. Emma submits the supplementary declaration before July 2021 (6 months after the import date). 16. Emma has registered for a duty deferment account, which is debited after she has submitted the supplementary declaration. 4. Emma has arranged collection of the goods from Felix with her haulage firm. ES administration HMG administration 10. Joe and the truck make the 35 minute crossing from Coquelles to Folkestone. No GB ENS data input is required by Joe, because the import is before 1 July* 2021. EAD MRN

40. 30 APPROACH: This is a movement of excise goods that start in excise duty suspension: The goods leave the excise warehouse in the EU under excise duty suspension on the EU EMCS system. On entry into Great Britain, they can be entered to free circulation, excise duty suspe nsion or customs special procedures such as customs warehousing. EU-GB: Duty Suspension EU E1 : Movement on EU EMCS from EU warehouse to GB . C1 : Export declaration made upon exit from EU . C2 : Under staged controls full import declaration made or if using CFSP, import declaration pre lodged before leaving the EU in GB. Goods declared to free circulation, excise warehousing or customs procedures. Goods arrived by end of next working day. GB E2 : EMCS movement closed on EU EMCS system . Key Excise Control Excise Destination Customs Control Customs Ctl. No Dec Excise Duty Point Excise Drawback UK Duty Secured for NI DP Movement DS Movement Excise Interaction Customs Interaction C x : Ex : E3 : If entered to excise warehousing, goods declared onto UK EMCS by the end of the next working day . E4 : If entered to free circulation no other formalities to complete at this stage. E5 : If entered to excise warehousing, UK EMCS is closed on receipt at GB warehouse . C3 : Under staged control, supplementary declaration submitted if CFSP used.

6. 1 Useful links for guidance on m oving goods between UK and EU from 1 January 2021 Getting Started: ● Keep Business Moving Trade with the UK from 1 January 2021 as a business based in the EU Brexit transition Starting to import: Moving goods from EU countries - GOV.UK ● Border Operating Model and How to import and export goods The Border with the European Union How to import goods from the EU into GB from January 2021 How to export goods from GB into the EU from January 2021 ● EstablishTerms and Conditions(Incoterms) International trade contracts and incoterms - great.gov.uk Incoterms® 2020 - ICC ● EORI Numbers Get an EORI number - GOV.UK EU National Customs Websites | Taxation and Customs Union ● Establishment in the UK Check if you’re established in the UK or EU for customs Who should register for VAT (VAT Notice 700/1) - GOV.UK ● Northern Ireland Sign up for the Trader Support Service Moving goods under the Northern Ireland Protocol

7. 2 Customs Procedures: ● Simplified Procedures Delaying declarations for EU goods brought into Great Britain from 1 Januar y 2021 Apply to use simplified declarations for imports Check if you can delay customs payments and declarations ● Deferred Duty Payments Apply for an account to defer duty payments when you import or release goods into Great Britain from 1 January 2021 ● VAT Who should register for VAT (VAT Notice 700/1) - GOV.UK VAT registration - GOV.UK ● Tariffs Check UK trade tariffs from 1 January 2021 - GOV.UK ● Customs intermediary or agent List of customs agents and fast parcel operators in UK ● Excise Goods Exporting excise goods to the EU from 1 January 2021 Importing excise goods to the UK from the EU from 1 January 2021 ● Controlled Goo ds - Import Controls Import controls - GOV.UK ● Common Transit Convention European Commission Transit Manual UK Supplement to the Transit Manual

84. Case study 3 - exporting lamb (meat) - GB - EU via ferry from Port of Dover at January 2021 - using transit Bill - authorised consignor and transport Alex - authorised consignee UK Competent Authority (CA) BCP / SIVEP / FR controls Ferry operator (FO) Luke - Exporter 4a. Luke receives original signed EHC from UK CA. He sends a scanned copy of it to Alex and gives the original signed EHC to Bill. 5a. Luke appoints Bill’s firm to move the goods using transit/CTC. Bill is an authorised consignor and has a transit guarantee in place, and he is also providing the transport. 5b. Bill pre-lodges a combined export and safety and security declaration (EXS) into CHIEF generating an EAD. 5c. Bill starts the transit movement, gets the LRN from NCTS. He also includes his pre-notification number in box 44 of the TAD. NCTS validates and sets the TAD and the transit movement can start. The MRN is produced and the paper TAD with the MRN on it is given to Bill. The paper TAD with the MRN on it must be given to BIll to be carried physically with the consignment 1. Luke sells lamb for export to the EU.He has a GB EORI number. Luke premises is listed as an authori sed establishment by the UK and EU Competent Authorities. The meat has a GB health identification mark. Luke has spoken with his logistics provider, Bill to discuss the BCP / SIVEP in the Port of Calais and has arranged with SIVEP for the goods to arrive. *BCP open 24/7 for POAO 2. Luke has applied via the new EHC-on line system for an Export Health Certificate (EHC) and downloaded the form from TRACES to send to the APHA & the consignments are made available for inspection 3. UK International Trade Centre check application on-line with destination export requirements. CA dispatch the EHC on EHC-O, and the certifier receives a notification on their dashboard. Meat passes inspection by CA - and is stamped to generate the EHC which is signed by the CA. 6. Bill holds an EU EORI number and has therefore made the ENS entry into the French Import Control System (ICS) using an EDI / ICS service within two hours of the arrival of the ferry. He ha s now received P2P / departure message from CHIEF, and the export is discharged. Bill is an existing FO customer and has signed the terms and conditions of carriage. He has completed the “checking HGV ready” and a Kent Access Permit has been issued and he sets off for Port of Dover 7a. The TAD barcode is scanned at the ferry check-in at Dover and Bill also confirms he is transporting meat and is informed that the status of the consignment will be default “ orange - douane ” and he may need to take the consignment to the BCP / SIVEP in the Port of Calais. At check-in, the number plate (ANPR) of Bill’s truck is captured and that data is paired with the MRN of his TAD. Bill boards the ferry, watches the screens in the drivers lounge and the ferry departs. 7b. FO sends the message to SI Brexit 10 mins after the ferry has departed. The DELTA T will check in TRACES if there is a valid EHC. DELTA T continually checks the status in TRACES until the arrival of the Ferry. 7c. The consignment is selected for SPS control and the status on the ferry lounge TV screens changes to “ orange - SIVEP ” 4c. Having received the scanned EHC back from Luke, Alex uploads it to TRACES NT the scanned signed EHC. 11. Bill leaves the BCP / SIVEP and continues to the delivery address 12. Alex is an authorised consignee for transit movements. Bill arrives at Alex’’s premises. Alex checks NCTS and sees that the office of transit function has been completed. Alex then uses NCTS to end the transit movement and discharges the T form by releasing the meat into free circulation using an import declaration and pays the relevant duties and import VAT 8. Bill follows the signs for the BCP / SIVEP and presents, the original EHC via the commis 9a. All goods undergo document inspection . ✔ All goods undergo identity checks . ✔ The rate of inspection is set by the EU rules BCP / SIVEP may hold goods whilst tests take place The lamb is not selected for further laboratory tests. BCP / SIVEP updates TRACES NT with outcome of inspection and approval by CA is also required prior to release. *If goods do not pass inspection, they are subject to special treatment, either re-exported (not necessarily to GB) or destroyed. EU BCP will alert relevant CA 10. In the case of a common transit declaration, once the checks have been carried out, Alex (as the declarant) has to communicate through an electronic mail to the transit office, the following information: - the pdf of the CHED issued by the border control post (SIVEP); - the reference of the transit declaration, as well as the transit office concerned. Based on these elements, customs officers will notify the passage in Delta T 4b. Alex has submitted the Common Health Entry Document (CHED) - pre-notification at least one working day in advance of the arrival of the meat - to TRACES NT

9. 4 Trading CITES-listed specimens through UK ports and airports from 1 January 2021 ● Food Labelling Food and drink labelling changes from 1 January 2021 Importing and exporting plants and plant products from 1 January 2021 Food Standards Agency: Homepage Importing products of non-animal origin ● Exporting Medicines to the EU Register for the National Export System to make an export declaration ● Controlled Goods- Import/Export Licences Controlled drugs: import and export licences - GOV.UK ● CE and UKCA markings / Regulations of Manufactured Goods Placing manufactured goods on the market in Great Britain from 1 January 2021 Using the UKCA mark from 1 January 2021 - GOV.UK Conformity assessment bodies: change of status from 1 January 2021 ● UK Strategic Exports UK Strategic Export Control Lists - GOV.UK Transport: ● Haulier’s handbook Transporting goods between Great Britain and the EU from 1 January 2021: guidance for hauliers and commercial drivers ● Check a HGV is ready to cross the border and Kent Access Permit check- an -hgv- is -ready- to -cross-the-border-demo.fbplatform.co.uk/ ● ECMT

8. 3 Importing and Exporting Animal Food and Plants: ● Export Health Certificates Get an Export Health Certificate ● Live Animals and Animal Products - GB - EU Importing animals, animal products and high-risk food and feed not of ani mal origin from 1 January 2021 Importing products of non-animal origin Find an export health certificate - GOV.UK UK border control posts: animal and animal product imports ● High Risk Food and Feed Importing high-risk food and feed ● SPS - guidance on plant and plant product imports Plant Health Portal - Post Transition Guidance Importing and exporting plants and plant products from 1 January 2021 Importing products of non animal origin ● SPS - List of high priority plants High Priority Plants ● ISPM15 International wood packaging standards IPPC - Regulation of wood packaging material in international trade ● Chemicals How to comply with REACH chemical Regulations ● CITES (International Trade in Endangered Species) Import or export endangered species: check if you need a CITES permit Apply for CITES permits and certificates to move or trade endangered species

Vistas

- 3312 Vistas totales

- 3019 Vistas del sitio web

- 293 Vistas incrustadas

Acciones

- 0 Acciones Sociales

- 0 Me gusta

- 0 No me gusta

- 0 Comentarios

Share count

- 0 Facebook

- 0 Twitter

- 0 LinkedIn

- 0 Google+

Incrusta 7

- 7 beta.astic.net

- 8 astic.net

- 17 ftp.astic.net

- 6 52.49.10.90

- 12 52.49.10.90:8069

- 3 web.astic.net

- 1 ec2-52-49-10-90.eu-west-1.compute.amazonaws.com

-

-

NP Astic aplaude la sentencia en firme del TS

11879 Views . -

ASTIC en los medios 22012016

11422 Views . -

ASTIC en los medios 29012016

11132 Views . -

ASTIC PARA ENCUENTRO HISPANO LUSO GAS NATURAL

11886 Views . -

Cifras que amenazan al sector del transporte en Europa

13257 Views . -

Analisis ASTIC del Mapa impositivo de la UE

12377 Views . -

2067 Legislacion 4t 2014

3111 Views . -

2068 Italia. Restricciones 2015

3392 Views . -

N.I. 1.16. Libro Naranja

7037 Views . -

N.I. 2.16. Borrador DGT megacamiones

7526 Views . -

2069 Corporate compliance

3079 Views . -

2070 Francia. Restricciones 2015

2951 Views . -

2071 Rumania. Restricciones 2015

3013 Views . -

2072 Grecia. Restricciones 2015

2783 Views . -

2073 Croacia. Restricciones 2015

3097 Views . -

2074 Pleno CNTC enero 2015

2790 Views . -

2075 Pais Vasco. Restricciones 2015

3203 Views . -

2076 Navarra. Restricciones 2015

3065 Views . -

2077 Cataluña. Restricciones 2015

2974 Views .

-

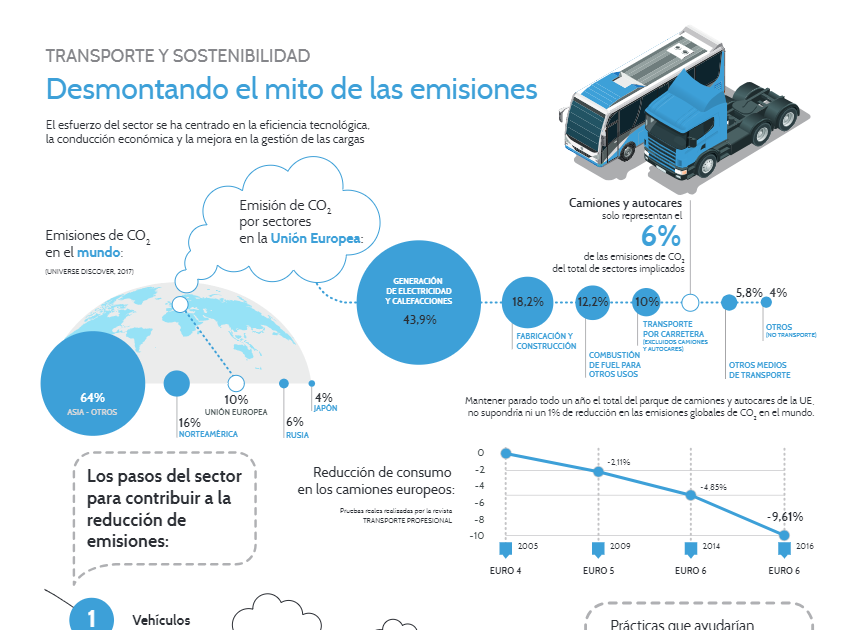

Infografía CO2

13363 Views . -

Cifras que amenazan al sector del transporte en Europa

13257 Views . -

-

Analisis ASTIC del Mapa impositivo de la UE

12377 Views . -

ASTIC en los medios 07.04.2017

11931 Views . -

ASTIC PARA ENCUENTRO HISPANO LUSO GAS NATURAL

11886 Views . -

NP Astic aplaude la sentencia en firme del TS

11879 Views . -

NP ASTIC Directiva de Trabajadores Desplazados

11618 Views . -

TRANSPORTE POR CARRETERA EN ESPAÑA Y EN EUROPA

11599 Views . -

Reacción Transporte Internacional BREXIT

11585 Views . -

ASTIC en los medios 19022016

11520 Views . -

ASTIC en los medios 22012016

11422 Views . -

ASTIC en los medios 02.06.2017

11413 Views . -

ASTIC en los medios 23032016

11403 Views . -

ASTIC en los medios 29012016

11132 Views . -

-

Nombramiento. Gervasio Pereda, nuevo director de SETIR

11047 Views . -

-

Encuentro IRU Comisión Servicios Madrid, 17032017

10614 Views . -

030117_NP_Sistema de seguimiento de camiones_eCMR

10340 Views .